Deal to avoid US debt default nixes proposed 30% crypto mining tax, says Ohio lawmaker

A tentative deal aimed at stopping the United States government from defaulting on its debts would likely eliminate a proposed tax on the energy usage of cryptocurrency miners, according to Ohio Rep. Warren Davidson.

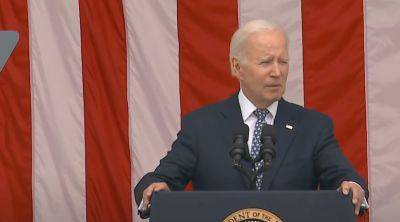

On May 28, U.S. lawmakers released a draft of a bill allowing the government to increase the debt ceiling — an imposed limit on the amount of debt the Treasury Department can incur — following negotiations with President Joe Biden and House Speaker Kevin McCarthy. The legislation still needs congressional approval before taking effect to avoid a seeming economic catastrophe for the U.S. government.

Under the proposed bill, there would be a two-year suspension of the debt ceiling, allowing the U.S. government to continue to borrow money and settle its debts. President Biden reportedly wanted the deal to include certain tax increases for corporations and high-income individuals, but the most recent draft suggested this was unlikely.

In a May 28 tweet, Davidson said the bill blocked “proposed taxes,” including a 30% tax on electricity used by cryptocurrency miners that had been suggested as part of President Biden’s FY2024 budget. Should the latter have passed, miners could have faced a 10% tax increase each year over three years on electricity generated starting in 2024.

“The agreement [...] represents a compromise, which means no one got everything they want,” said President Biden following negotiations. “The agreement prevents the worst possible crisis, a default, for the first time in our nation's history.”

Yes, one of the victories is blocking proposed taxes.

Related: New White House standards strategy could have implications for crypto industry KYC

Many in the space had criticized the White House and

Read more on cointelegraph.com