Cryptocurrency in 2022: What it was, what it is, and what to expect in 2023

The year 2022 was turbulent for cryptocurrency. Tightening monetary policy and geopolitical pressures led to a major sell-off in the industry. Following hawkish commentary from the Reserve Bank of India (RBI), the Indian government imposed a flat 30 per cent tax and an additional 1 per cent tax deducted at source (TDS) on the transfer of crypto tokens in this year's Budget.

In addition to this, the RBI launched its own digital currency, Central Bank Digital Currency (CBDC) in 2022.

Just as the market was beginning to stabilise in the second half of FY23, the collapse of FTX exacerbated the situation. Once the third-biggest crypto exchange, it took just a couple of days for FTX to wipe out billions of dollars. The total market cap of the industry has fallen close to $200 billion since the fraud surfaced in early November. Since the fallout, several exchanges have started publishing their proof-of-reserves to allay the investors' fears.

Several other firms like Celsius, Three Arrows Capital, and more recently, Core Scientific filed for bankruptcy in 2022.

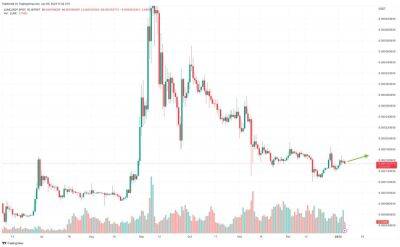

Overall, the year saw bear hug in the crypto industry. Bitcoin, the largest cryptocurrency by market cap, was trading at $47,098 at the start of 2022. By December 25, it had fallen to $16,880.

Business Standard talked to various crypto firms in India about how 2023 will be for the industry.

WazirX: Nischal Shetty, CEO

"After the market crash of 2022, the whole community has gone into a recovery mode -- building resilient, viable products, introducing measures to stay afloat, building secure infrastructure, etc. As we continue to see long-term Crypto supporters HODL their assets, it is also a common expectation that the market will be back on its feet soon. However, we

Read more on business-standard.com