Crypto weekly wrap: Tokens recover after plunging post-US inflation data

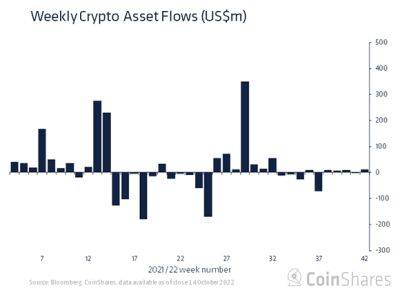

The cryptocurrency market has been trading in the green since the release of US inflation data on Thursday. Bitcoin, the largest digital token by market capitalisation, gained nearly 4 per cent. Ethereum was also up 4 per cent. Almost all the other major digital tokens like BNB, Cardano, Solana, and Tether were also in the green, according to coinmarketcap.

The rise has been attributed to a fall in US inflation. At 8.2 per cent in September, the inflation was higher than the expected 8.1 per cent but lower than August's 8.3 per cent.

"Bitcoin traded most of the week flat and rose nearly 4 per cent on Thursday after the release of the US Consumer Price Index data, which was higher than expected. BTC rose by almost 4 per cent after dropping to its lowest at $18,300 post-CPI's release," Edul Patel, CEO and co-founder of global crypto investing platform Mudrex, said.

However, the crypto market cap has fallen in the last seven days. On Friday, the crypto m-cap was at $936 billion. It was $957 billion on October 7. Just after the release of US inflation data, the m-cap had fallen to $882 billion.

When taken for the last week, "The top 20 tokens are trading in the red with Cardano, Solana, and Binance Coin slipping over 10 per cent during the week," Parth Chaturvedi, crypto ecosystem lead at crypto exchange CoinSwitch, said.

On October 10, the Organisation for Economic Co-operation and Development (OECD) released the Crypto-Asset Reporting Framework (CARF) to exchange information between countries on crypto-assets automatically.

"CARF will ensure transparency with respect to crypto-asset transactions, through automatically exchanging such information with the jurisdictions of residence of taxpayers on an annual basis, in a

Read more on business-standard.com