Crypto-related stocks jump in positive reaction to executive order

The stock prices of crypto-related companies have jumped as the broader market reacted positively to President Joe Biden’s long-awaited executive order requiring US federal agencies to create a regulatory framework for digital assets, as well as exploring a future digital dollar.

Coinbase (COIN) surged, up 10.5% at market close, while shares in Bitcoin-evangelist Michael Saylor’s MicroStrategy (MSTR) posted a 6.4% gain, according to TradingView.

Blockchain-related exchanged-traded funds (ETFs) also enjoyed the markets’ renewed confidence in crypto, with ProShares Bitcoin Strategy ETF (BITO) gaining 10% and Valkyrie Bitcoin Strategy ETF (BTF) closing up 10.3%.

Cryptocurrency mining companies enjoyed the largest gains with Riot Blockchain Inc. (RIOT) shares up 11.2% and Marathon Digital Holdings Inc. (MARA) rose 13.5% with Jefferies (JEF) analyst Jonathan Peterson, reportedly restoring his buy rating for MARA in a note to clients and stating that crypto miners are likely to gain now that the U.S Government is “more formally recognizing, engaging with and seemingly supporting” the digital asset industry.

While 10% swings are common in crypto, these are unusually volatile moves on traditional markets. And despite the past day's increase, Coinbase is still down nearly 48% from it’s direct listing price in Apr. last year, while RIOT is in an even worse position, currently down 76% from it’s most recent high in Feb. 2021.

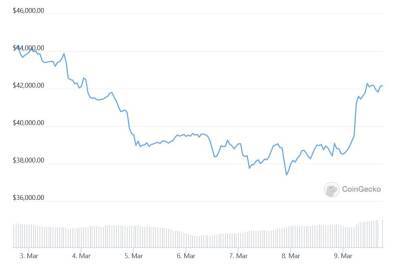

Bitcoin (BTC) itself jumped 9% after details concerning the executive order leaked last night, before settling back to the current 5% gain.

Aside from the immediate positive price action, the executive order was considered by most investors to be if not a net positive for the crypto industry, at least a lot

Read more on cointelegraph.com