Crypto Products See $1.3B Inflows in One Week: CoinShares

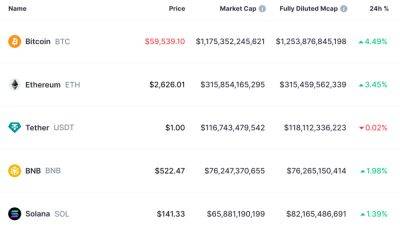

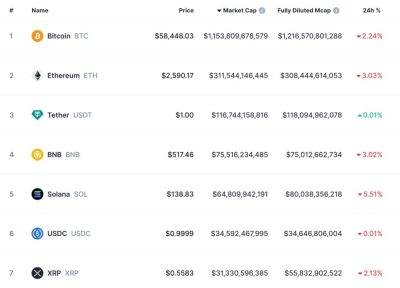

Cryptocurrency investment products received a major investment of $1.35 billion in the past week, per CoinShare’s latest data. Last week’s numbers bring the total capital attracted by these products to $3.2 billion in the last three weeks, indicating a growing interest in crypto products.

According to the CoinShares report, Bitcoin received $1.27 billion in inflows last week.

Digital asset investment products saw further buying with inflows of $1.35bn last week, bringing the last 3 week run of inflows to $3.2bn. pic.twitter.com/Y1CEh36q6a

— unfolded. (@cryptounfolded) July 22, 2024

Meanwhile, the prospects for Ethereum seem to have improved as it saw more inflow of $45 million last week, surpassing Solana for the altcoin with the most inflows year-to-date (YTD) at $103 million.

Solana didn’t fare too badly, as it saw $9.6 million in inflows last week. It is now behind Ethereum, with $71 million in inflows year-to-date. Litecoin was the only other altcoin to see over $1 million in inflows, with $2.2 million last week.

Recall that Cryptonews reported on July 15 that digital asset products recorded $1.44 billion in inflows, with the United States accounting for $1.3 billion of the total inflows.

The report aligns with data from Farside Investors, which shows that US Bitcoin spot exchange-traded funds (ETFs) have reached a record high of over $17 billion in net inflows. BlackRock’s IBIT leads the way with $18.9 billion, followed by Fidelity’s FBTC with $9.8 billion.

These impressive inflows indicate that institutional investors are increasingly embracing Bitcoin products. BlackRock, a leading asset manager, has greatly boosted its Bitcoin holdings in recent weeks, with its total value now exceeding $20 billion after a recent

Read more on cryptonews.com