Crypto exchanges need to start giving customers their keys

The business model that cryptocurrency exchanges currently use relies on ignorance and fear.

It relies on their customers not knowing much about decentralized finance (DeFi)and their fear of what could happen if they get things wrong with their crypto investments.

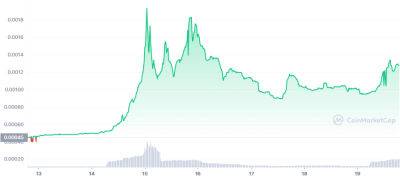

Cryptocurrencies seem like an obscure and risky investment to most, and unsurprisingly, concerns about losing assets in market crashes, losing wallets or security keys through carelessness, or being scammed by unscrupulous operators are prevalent. These concerns are reasonable considering the volatility of the market and the prevalence of sharks, crooks, bluffers and shysters who operate in the industry.

In theory, exchanges exist to assuage these concerns. They exist to mitigate that risk for your average retail investors, who are given a safety mechanism to hedge against losing their savings. This model has enabled exchanges to grow at an exponential rate in recent years and to create vast fortunes in the process.

However, it would be remiss of those who run crypto exchanges to assume that the current level of ignorance and the fear it engenders will remain in perpetuity. Customers are learning more all the time; they are becoming far savvier. The next generation is learning about crypto in a number of different ways, such as through market trends such as GameFi and nonfungible tokens (NFTs). As adoption spreads, the knowledge of the average customer increases accordingly. This, in turn, makes them less reliant on exchanges.

Related:FTX illustrated why banks need to take over cryptocurrency

Many customers will also have been spooked by stories about disgraced crypto entrepreneur Sam Bankman-Fried, who masterminded the implosion of FTX. In light of this,

Read more on cointelegraph.com