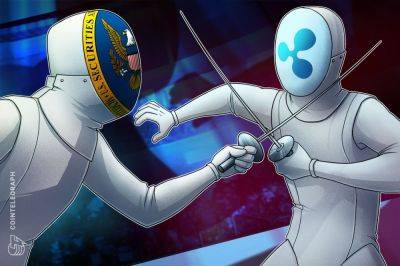

Court Trial Dates Set for SEC's Case Against Ripple Labs in Southern District of New York

In a filing on August 9th in the U.S. District Court for the Southern District of New York, Judge Analisa Torres, who is handling the civil case of the United States Securities and Exchange Commission (SEC) against Ripple Labs, intends to set a jury trial for the second quarter of 2024. The trial will be for motions she did not rule on during the motions for judgment.

In December 2020, the SEC filed a lawsuit against Ripple and its two executives, CEO Brad Garlinghouse and co-founder Chris Larsen, for an unregistered $1.3 billion securities offering by selling XRP, a token created by Ripple's founders in 2012. This move led several exchanges to remove XRP from their listings to prevent legal issues.

However, in this case, on July 13th, Judge Torres ruled that XRP sales on public crypto exchanges weren't securities offerings because buyers didn't expect profits tied to Ripple's efforts.

Torres cited a Supreme Court case that classifies investments in profits from others' efforts in a shared enterprise as securities.

Ripple's XRP sales, including those by executives and for employee compensation, were determined not to be securities when conducted through programmatic sales on digital asset exchanges.

Although the court ruling isn't a conclusive verdict in the SEC v. Ripple case, Garlinghouse, Larsen, and the blockchain firm could still face liability for other breaches; many companies have relisted XRP or shown intentions to do so.

According to the recent filing on Wednesday, Judge Analisa Torres has confirmed that a jury trial will proceed for Ripple, Garlinghouse, and Larsen. Both the prosecution and defense teams must provide blackout dates by August 23rd, with the trial expected to occur between April 1st and June 30th,

Read more on cryptonews.com