Cooling in US inflation, Shapella upgrade lifts crypto market; Bitcoin nears $30,500, Ether up 6%

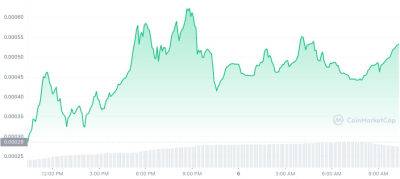

The crypto market continues it's gaining spree with the leader Bitcoin reaching near $30,500 levels, and Ethereum picking up by over 6%. There are a host of positives for cryptocurrencies. These would be sharp cooling in US inflation, and also Ether's Shapella upgrade which is set to be released. Globally, the market witnessed strong demand in both value and volume.

At the time of writing, on CoinMarketCap, the global crypto market traded at $1.25 trillion up by 2.29% over the previous day. The total volumes in cryptocurrencies zoomed nearly 20% to $48.78 billion over the previous day.

The market's biggest booster is inflation data. The US consumer price index of all items stood at 5% by end of March 2023 --- which is the lowest since May of 2021. It is also better than Street's expectations of 5.2%. However, inflation continues to stay above US Fed's target levels.

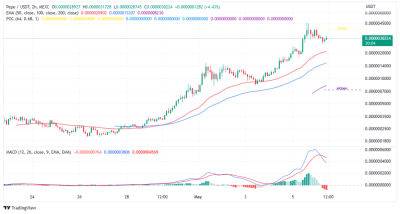

Bitcoin traded near $30,225 up by nearly a percent. The crypto has touched an intraday high of $30,462.48 --- which is the 7-day high and also a 1-month high. The crypto hit a 3-month high of $30,509.08 earlier.

CoinDCX Research Team earlier said that if March CPI will be lower than previous months, which could potentially benefit Bitcoin if the Federal Reserve decides to pause rate hikes.

Further, Ethereum which is the second largest cryptocurrency, traded near $1,982 up by 6%.

Both Bitcoin and Ether have recorded around 8% and 6% jump in 7 days.

On the latest cryptocurrencies performance, Sumit Gupta, Co-Founder & CEO, CoinDCX said: “The ETH Shapella upgrade is important on 3 counts: security, improved user experience, and more control. The upgrade involves making changes to two important layers in the network - the execution layer and the consensus layer.

Read more on livemint.com