Coinbase Launches $150 Million Corporate Bond Buyback Program- Crypto Bull Market Back?

United States' largest digital asset exchange Coinbase has announced plans to buy back a portion of its corporate $1 billion debt.

The repurchase plan will see the company buy up to $150 million of its bond which is expected to mature 2031 following positive earnings in the second quarter of the year amid regulatory pressure by the Securities and Exchange Commission (SEC).

According to a statement released by the exchange on Aug 7, the offer is valid until Sept 1, 2023, with Citigroup’s brokerage arm in charge of facilitating the repurchase as the company looks to reduce interest expenses.

The Nasdaq-listed exchange will initiate the buyback program at a premium across multiple tiers structured into time frames and volume.

According to data from Business Insider, the present bond unaffected price stands at 60 cents on the dollar.

Investors who offer their bonds before Aug 18 have been incentivized with $645 for every $1000 of bonds which equates to 64.5 cents to the dollar. In addition to this, the bondholders will be issued an early tender premium of $30.

Investors who opt to sell after Aug 18 but before Sept 1 will still be offered at a premium of $615 for every $1000 which stands at 61.5 cents to the dollar.

The decision has sparked debate over a change in the market's outlook in the coming months after Coinbase posted positive financials compared to previous quarters.

The firm kept its net loss at $97 million in Q2 2023 against the huge $1.1 billion loss in Q2 2022 although its revenue recorded a 17% decline.

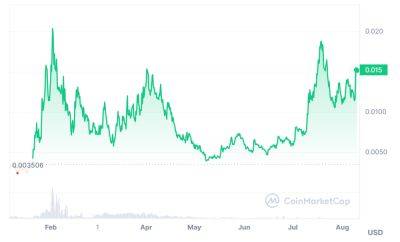

The crypto market has traded sideways for a couple of months although this year sparked a huge turnaround following terrible incidents of 2022 including the crash of Terra and the infamous implosion of FTX.

As

Read more on cryptonews.com