China to gain most from restrictive US crypto regulations: Coinbase CEO

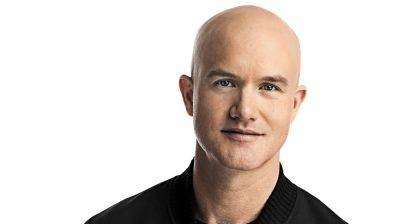

“Adversary nations” like China could ultimately benefit from restrictive crypto policies in the United States, warns Coinbase CEO Brian Armstrong.

In a May 30 op-ed for MarketWatch, Armstrong again warned that while recent turbulence in crypto markets might tempt U.S. policymakers “to write it off as an unstable asset class,” doing so could see the U.S. cede its status as a financial leader and innovation hub.

In today's @MarketWatch I'm sharing an op-ed encouraging policymakers to see the big picture with crypto. It's important for American technology leadership and national security that this industry be built (at least in part) in America. https://t.co/I1702aHDGf

Armstrong urged policymakers to see that crypto is “about much more than individual transactions,” but represents a “transformative technology” that can revolutionize a variety of sectors — highlighting its ability to provide creators with royalties for secondary market transactions as an example and adding:

Through his status as a public figure and head of Coinbase, Armstrong has long been pushing for U.S. policymakers to provide the crypto industry with regulatory clarity that can help realize crypto’s potential whilst protecting consumers.

Coinbase has continued to ask for clarity from the U.S. Securities and Exchange Commission around which digital assets qualify as securities and has argued against the agency’s “regulation by enforcement” approach. SEC chair Gary Gensler has previously argued that digital assets already fall under existing securities regulations.

Related: SEC settles case against Wahi brothers for Coinbase insider trading

In the op-ed, Armstrong added it was unsurprising that Hong Kong is positioning itself to be a global crypto hub, as

Read more on cointelegraph.com