Celsius had 'insufficient' accounting and operational controls, says examiner

The independent examiner in crypto lender Celsius’ bankruptcy case has alleged that the company failed to set up “sufficient” accounting and operational controls in its handling of customer funds.

In an interim report released on Nov. 19, examiner Shoba Pillay made a number of stark observations in her court-appointed investigation into the bankrupt cryptocurrency lending platform.

One of the main revelations in Pillay’s report was that Celsius’ “Custody” program was launched “without sufficient accounting and operational controls or technical infrastructure,” which allowed shortfalls in Custody wallets to be funded from its other holdings.

When it was launched on Apr. 15, Celsius’ Custody program allowed users to transfer, swap and use coins as loan collateral. It was introduced after the firm was ordered by the New Jersey security regulators to create a product that was distinguished from Celsius’ “Earn” product, which receives rewards.

This co-mingling of wallets means that there is now uncertainty on which assets belonged to the customer at the time of the bankruptcy filing, said Pillay, noting:

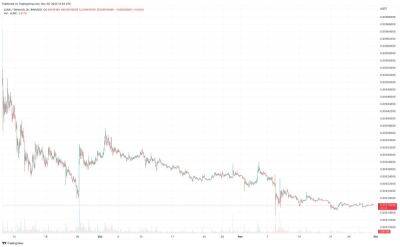

The interim report has also shed light on what ultimately forced the lending platform to halt withdrawals on Jun. 12.

Pillay said the breaking point came around on Jun. 11, when customers’ Custody wallets became underfunded. By Jun. 24, this fell a further 24% to $50.5 million in underfunding.

The revelation comes as a filing with the New York-based bankruptcy court last week states that Celsius customers must file claims against Celsius by Jan. 3. 2023 in order to be eligible for distributions from the case.

However, customers who agree with Celsius’s scheduling of their claims do not need to submit proof of claim, according to

Read more on cointelegraph.com