CBDCs on the Rise: What the Decline of Physical Cash Means for Blockchain and Privacy

Key Takeaways

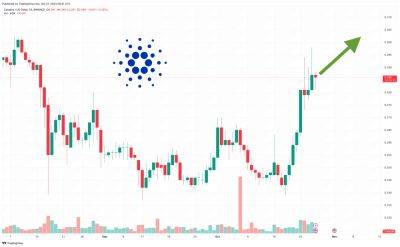

* By 2028, only 9% of all payments are expected to be made in physical currency.

* Central Bank Digital Currencies (CBDCs) are under development, but their design raises questions about privacy and personal freedom.

* Critics argue that digital payment systems, unlike cash, can be monitored and can refuse service without consequence.

The Inevitable Decline of Cash

According to a report by the World Economic Forum dated September 26, 2023, the use of physical cash has been declining at a rate of approximately 15% each year since 2017. The report estimates that by 2028, a mere 9% of all payments will be made using physical currency. This decline is not expected to happen overnight but is seen as an inevitable outcome due to the individual choices of millions of citizens and merchants.

Convenience Versus Privacy

The shift towards digital payments is largely driven by convenience. However, this convenience comes at the cost of personal freedom and privacy. Unlike digital payments, cash transactions do not require authorization from any third party, and they leave no trace. David Smith, Economics Editor at The Times, questioned the need for a digital cash replacement, stating, «Why would anybody bother? If I am happily, or in some cases not so happily, using contactless payments now, why would I go to the trouble of loading up a digital pound wallet to use that instead?»

The Role of Central Banks and CBDCs

Central banks are considering the introduction of retail Central Bank Digital Currencies (CBDCs) as a digital cash replacement. However, the design of these CBDCs is a subject of debate. Critics argue that if CBDCs do not offer the same level of privacy and freedom as cash, they could face

Read more on blockchain.news