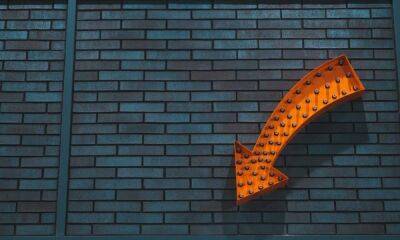

Bitcoin 'very bearish' below $22.5K says trader as BTC price dives 6%

Bitcoin (BTC) fell rapidly on Aug. 19 as the culmination of a week’s sideways action ended in disappointment for bulls.

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it dropped 6.2% in a single hourly candle.

Reacting, traders hoped that a rebound could allow for consolidation higher than current spot price levels, which were under $22,000 at the time of writing.

“Well, hopefully that was liquidity seeking, otherwise it's over,” a gloomy Crypto Chase told Twitter followers.

Fellow account Il Capo of Crypto, who had long forecast a return to lower levels, was resigned to new lows being “just a matter of time.”

Consolidation under $22,500, he warned in his latest update, would be “very bearish.”

$BTCSecond option playing out. Any test of 23500 as resistance is a good sell opportunity.Consolidation below 22500 (clean break + use the level as resistance) would be very bearish = 21k or lowerNew lows are just a matter of time. https://t.co/MzxrDCZuiZ pic.twitter.com/I5PatYduNW

Prior to the drop, meanwhile, analyst Venturefounder said that any price below $23,000 would be a “decent price to buy in the long term,” adding that it was unlikely that Bitcoin had exited its bear market so far.

Relative strength index (RSI) being still near all-time lows spoke to the extent to which BTC/USD was oversold, he argued.

There were nonetheless signs of buying emerging below key bear market support levels including the 200-week moving average and key whale entry levels.

According to data from on-chain analytics firm CryptoQuant, exchange outflows for the first few hours of Aug. 19 already totaled 21,500 BTC.

On altcoins, the knock-on impact of Bitcoin’s return to three-week lows was predictably keenly felt.

Related: Options

Read more on cointelegraph.com

![Evaluating if Bitcoin [BTC] can see a leg-down to $9k mark - ambcrypto.com - city Santiment - city Santimenteven](https://gocryptonft.com/storage/thumbs_400/img/2022/8/24/62173_8j5i.jpg)

![Alexandre Dreyfus - Au Revoir Ethereum, Chiliz [CHZ] has relied enough on you - ambcrypto.com - city Santiment](https://gocryptonft.com/storage/thumbs_400/img/2022/8/23/61922_ubqx.jpg)