Bitcoin spikes 5% as cryptos continue to surprise investors. What lies ahead for digital currencies?

Staying true to its character of extremely volatile asset, bitcoin jumped 5.27 percent in the past 24 hours on Thursday to trade at $67,170 in the international crypto markets, CoinDesk data shows.

Bitcoin saw a decline of upto 10 percent early this week on profit-booking before the sentiment reversed following US Fed Reserve head Jerome Powell’s dovish speech. After this, crypto tokens started rising again.

While the much sought-after crypto token spiked over 5 percent, Ethereum rose 6 percent to trade at 3,555, Binance Coin jumped 5.6 percent to $562 and solana spiked nearly 10 percent to $190, shows Coindesk data.

Additionally, dogecoin surprised the crypto market by rising up to 18 percent.

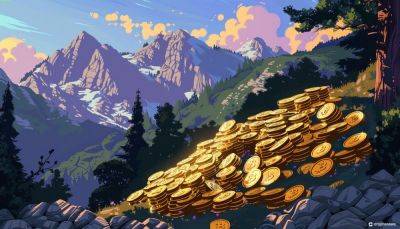

(Source: Coinmarketcap)

One can check the table above to get a sense of the wide volatility reflected by bitcoins in the past few days. While the bitcoin price hit as high as $73K on March 13, it declined to $61K on March 19.

Again, it spiked to $67,000 today, while it stays 8 percent lower than the all-time high of $73,127.

“The volatility in cryptocurrency prices often underscores the manipulative nature of the crypto economy. Despite claims of trillions of dollars in fully diluted market cap, calculated by multiplying price by max supply, the actual liquidity available on exchanges is far more limited. This susceptibility to manipulation becomes evident when considering the relatively small amount of liquidity, often just a few hundred million dollars," explains Gaurav Mehta, Co-founder and CEO of Catax- Simple Crypto Taxes.

Notably, Bitcoin hit $73,000 on March 13 to become the eighth largest asset worldwide by market capitalisation. The momentum of price jump was built after the US markets regulator Securities and Exchange

Read more on livemint.com