Bitcoin Price Prediction: ETFs Boost BTC to $43,500, Japan Tax Reforms in Play

In a remarkable surge, Bitcoin has reached $43,499, marking a 0.71 percent increase on Tuesday. This notable ascent can be largely attributed to the burgeoning interest in Spot Bitcoin ETFs, which are poised to surpass the combined inflows of all 150 crypto ETPs currently in the market.

Adding to the positive momentum, Japan’s Cabinet has recently proposed a groundbreaking reform, aiming to eliminate the corporate tax on unrealized cryptocurrency gains. This move could significantly influence the global crypto landscape.

Meanwhile, in the United States, a Representative has highlighted a series of crypto bills that have been approved by the House Committee this year, signaling a growing legislative interest in the crypto sector. These developments collectively underscore a pivotal moment for Bitcoin and the broader cryptocurrency market.

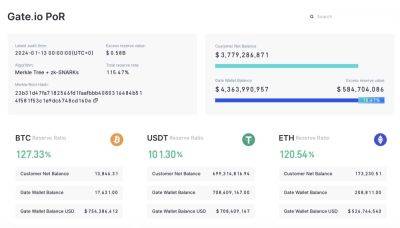

The landscape of cryptocurrency investment is undergoing a seismic shift. Currently, the market boasts 150 crypto exchange-traded products (ETPs), amassing an impressive $50.3 billion in assets under management. This collection primarily includes funds tracking the titans of the crypto world, Bitcoin and Ethereum.

In a significant development, Grayscale’s Bitcoin Trust, the largest player in the ETP arena, is ambitiously vying to transform into a spot ETF.

The potential for spot Bitcoin ETFs to gain a foothold in the United States paints a promising picture, with expectations of surpassing the entirety of the current $50 billion crypto ETP market.

In just a few years, spot Bitcoin ETFs could be bigger than the entire $50 billion global crypto ETF market today. https://t.co/AZKuv8txlc

— Cointelegraph (@Cointelegraph) December 26, 2023

Analysts are casting bullish forecasts, envisioning a

Read more on cryptonews.com