Bitcoin Price Prediction – Can Bulls Push BTC Up 50% This Week?

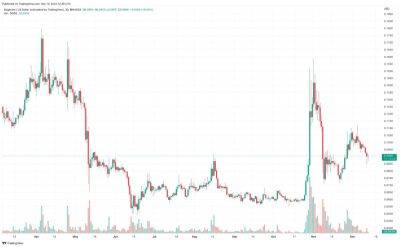

On Sunday, Bitcoin price prediction remains neutral, as BTC has failed to break out of a narrow range of $16,850 to $17,250. Bitcoin miners appear to have given up on the long-term profitability of holding any significant amount of the pioneer crypto and are instead selling off enormous quantities of Bitcoin.

CryptoQuant has revealed that on December 1st, Bitcoin miners dropped 10,000 BTC. Compared to the 2,569 units that entered the market and were subsequently sold by miners on November 26th, this amount is much lower.

Joaowedson, a CryptoQuant analyst, weighed in on the subject, citing the high cost of Bitcoin mining and the precipitous decline in value of the crypto asset as causes.

Joaowedson added:

"Miners are being compelled to sell their stakes because of the present price of Bitcoin and the high cost of mining in various countries."

The "makers" of the largest cryptocurrency by market cap and the asset itself are both doomed in their current states. Because of the recent drop in Bitcoin's value and the high cost associated with creating a single Bitcoin, Bitcoin miners may no longer make a profit from their efforts.

The price of the cryptocurrency could fall and its volatility could increase if they keep dumping the results of their labor into the market. Past market selloffs have also had an impact on mining industry earnings.

Glassnode reports that miners made 814.28 BTC at the time this article was written. Given this, it's not hard to see how one may conclude that Bitcoin doesn't provide anything in the way of rewards or transaction fees for its miners.

Another key reason supporting BTC prices was the fall of the US dollar, which touched a three-month low.

Investors took advantage of unexpectedly favorable job data,

Read more on cryptonews.com