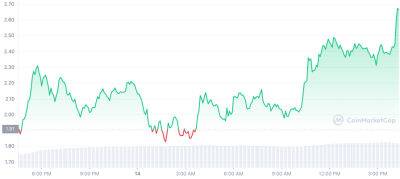

Bitcoin Price Prediction – Can BTC Stay Above $20,600 Into The Weekend?

The Bitcoin price is rising during the European session, breaching the descending triangle pattern at $20,400. Recalling the Asian session's Bitcoin price prediction, the market was waiting for non-farm payrolls and the unemployment rate in the United States to determine further price action.

A day after the Federal Reserve announced another rate hike, the government released its final jobs report before the midterm elections, showing that the unemployment rate had remained unchanged at 3.7%.

Let's take a closer look.

US Non-farm Payroll: According to the US Bureau of Labor Statistics, more than twice as many jobs were added to the US economy in October 2022, with 261,000 new positions created. This is the lowest reading since December 2020, but data nevertheless hint at a robust, if sluggish, labor market as worker shortages continue to bite.

Unemployment Rate: Incredibly, the most recent data shows that the US

is even stronger than previously thought. Though it has increased, the jobless rate is still at a 50-year low level of 3.7%.

This development follows a recent interest rate hike by the Federal Reserve, which was intended to reduce investment and inflation but which economists and the Fed both agree will have a negative impact on employment in the long run.

The Fed's policies, the most draconian since the 1980s, have had little effect on the red-hot labor market in the United States thus far. As of mid-2020, the average monthly increase in employment was 562,000; by mid-2022, that number had dropped to 407,000.

Average monthly job gains in 2019 were 164,000 before the coronavirus epidemic hit the United States.

The current Bitcoin price is $20,761, with a $42 billion 24-hour trading volume. During the Asian session,

Read more on cryptonews.com