Bitcoin Price Prediction as BTC Jumps Above $70,000 Resistance – Time to Buy?

BTC has bounced by 2.5% in the past 24 hours, with the Bitcoin price reaching $70,561 on a day when the crypto market has gained by 1.5%.

Bitcoin is now up by 6.5% in a week but down by 2% in a month, with the biggest cryptocurrency also sitting on a 134% increase in a year.

Yet the next 12 months could be even better for Bitcoin than the previous, with today’s increase following from the expectation that rising inflation may force the Fed to bring rate cuts.

And with BTC also awaiting the next halving in just over a week, we could see further increases very soon.

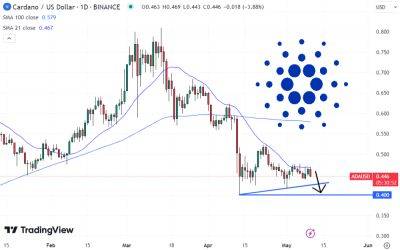

BTC’s chart continues to look encouraging, leaving it open for further rallies to come in the near term.

Its 30-day average (orange) began rising again yesterday and still has plenty of space to rise further before BTC enters overbought territory.

It’s much the same for BTC’s relative strength index (purple), which has risen from nearly 20 a couple of days ago to around 60 today.

This indicates that momentum has increased for Bitcoin, yet because the RSI hasn’t climbed over 70, we may see another wave of buyers very soon.

One other interesting detail of the above chart is that the coin’s resistance (red) and support (green) levels appear to be converging, a process that tends to suggest that a big move may be on the way.

Given that the halving is fast approaching, such a move does seem likely, and with BTC’s volume remaining high at $38 billion, it’s tempting to say that this move will be a positive one.

Indeed, yesterday saw Grayscale CEO Michael Sonnenshein declare that outflows from the firm’s Grayscale Bitcoin Trust may have reached equilibrium, implying that recent selling pressure is about to end.

#Bitcoin has a history of choppy price action during ATH breaks.

It

Read more on cryptonews.com