Bitcoin Price Prediction as BTC Crashes Before Halving – Is The Bull Market Over?

As the cryptocurrency community anticipates the next Bitcoin halving event, expected around April 19 or 20, speculations about its impact on Bitcoin’s price are intensifying.

This scheduled reduction in mining rewards, which decreases the supply of new Bitcoins entering the market, has historically been a catalyst for significant price movements.

Presently, Bitcoin (BTC/USD) is trading near $63000, showing a modest increase of 0.05% in the last 24 hours with a trading volume of approximately $44 billion.

With Bitcoin’s market capitalization holding strong at around $1.239 trillion, and nearly 19.7 million BTC in circulation, the market is closely watching how this halving could influence future Bitcoin price prediction.

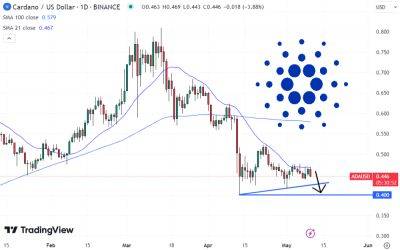

Bitcoin (BTC/USD) shows the pivot point at $61,415, which is critical for determining BTC’s short-term direction. Observing the immediate resistance levels, Bitcoin faces its first major challenge at $64,873.

Beyond this, additional hurdles stand at $67,846 and $71,608. Conversely, the support levels begin at $58,181, extending to $55,649, and further down to $52,859.

From a technical standpoint, the Relative Strength Index (RSI) is currently at 41, indicating that Bitcoin is neither overbought nor oversold at this juncture, suggesting a potential stability in price movements.

The 50-Day Exponential Moving Average (EMA) rests at $64,718, which is just above the current market price, signaling that there might be a slight bearish sentiment in the near term.

Notably, a ‘triple bottom’ pattern around the $61,400 level is providing substantial support for Bitcoin.

This pattern, coupled with the formation of a hammer candlestick pattern just above this zone, suggests that there could be a buying resurgence if Bitcoin

Read more on cryptonews.com