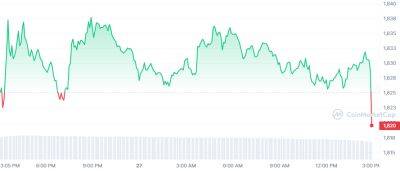

Bitcoin Price Prediction as Bitcoin Mining Difficulty Reaches New All-Time High – BTC Adoption on the Rise?

As Bitcoin mining difficulty hits an unprecedented high, the cryptocurrency's future price trajectory comes into focus.

The rising complexity of mining operations indicates a robust network and heightened interest in Bitcoin.

With mining becoming increasingly challenging, it begs the question: Is this surge in difficulty a precursor to a potential rise in Bitcoin adoption?

As more individuals and institutions embrace BTC, its value and market demand may witness significant growth.

In this Bitcoin price prediction, we delve into the correlation between mining difficulty and adoption, exploring the possibilities for Bitcoin's upward trajectory.

Bitcoin's mining difficulty level reached an unprecedented milestone on Thursday, surging by 3.22%.

This indicator measures the level of effort required for miners to validate transactions within a block, and a higher difficulty reflects heightened competition in the mining arena.

The recent adjustment placed the mining difficulty reading at 49.55 trillion at block height 790,272, rebounding from a 1.45% decline in the previous adjustment on May 4.

As more miners join the network, the mining difficulty naturally rises, impacting their profitability, which is closely tied to Bitcoin's spot price.

This upward trend in mining difficulty is closely correlated with the rise in hashrate, the measure of computational power utilized for mining, which currently stands at approximately 368.5 exahashes per second, up from 350.8 exahashes on May 4, according to data from Blockchain.com.

The number of people filing for initial state unemployment benefits decreased by 22,000 to reach a seasonally adjusted total of 242,000 in the week ending May 13.

This significant drop marks the largest decline

Read more on cryptonews.com