Bitcoin Price Drops Back Below $49,000 After Hot US CPI Data Deals Blow to Fed Rate Cut Bets – Where Next for BTC?

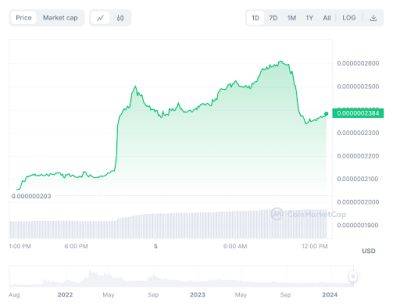

Bitcoin Price Chart / Source: Adobe / LuisaThe Bitcoin (BTC) price has dipped back below $49,000, a near $1,500 turnaround from the two-year highs it hit near $50,400 earlier in the session, in wake of the release of hotter-than-expected US Consumer Price Index (CPI) data for January.

Last changing hands around $48,500 on major cryptocurrency exchanges, the Bitcoin price was last down nearly 3% on the day.

The headline CPI rose 0.3% MoM in January, above expectations MoM price pressures to remain at 0.2%.

Meanwhile, Core CPI accelerated to 0.4% MoM from 0.3% in December, above expectations to remain unchanged at 0.3%.

The unexpected rise in inflationary pressures suggests Fed policymakers are right to be cautious about starting a rate-cutting cycle.

The data unsurprisingly forced macro investors to pull back on rate cuts bets.

As per the CME’s FedWatch Tool, money markets now imply a less than 40% chance that cuts start in May.

That’s down from over 60% just one day ago.

However, the market’s consensus bet remains that rate cuts start in H1 2024.

Money markets still imply a near-80% chance that cuts begin by June, down narrowly from 90% one day ago.

The prospect of interest rates remaining at higher levels for longer as the Fed takes a more cautious approach to rate cuts in light of hot US inflation data has seen US government bond yields and the US Dollar Index (DXY) vault higher on Tuesday, with the US 10-year yield last around 10 bps higher on the day near 4.3%, and the DXY last at more than two-month highs above around 104.75.

The jump in US yields is weighing on interest-rate-sensitive assets, like US equities, gold and crypto.

The S&P 500 dipped over 1% on Tuesday and is back under 5,000.

Gold was last down around 1.4% and

Read more on cryptonews.com