Bitcoin Price and Ethereum Prediction; BTC Mining Difficulty Drops 3.6%

Bitcoin is trading with a bullish bias on January 3rd after breaking above the $16,650 level, and it is now likely to head for the $16,750 level. Ethereum, on the other hand, has breached a narrow range of $1,180 to 1,210 and is now heading north for new highs.

The global crypto market cap increased 1.25% to $805.12 billion on the previous day, as major cryptocurrencies traded in the green early on January 3. The overall crypto market volume in the last 24 hours has increased by 36.27% to $23.72 billion.

DeFi's total volume is currently $1.70 billion, accounting for 7.18% of the overall crypto market 24-hour volume. The overall volume of all stablecoins is now $21.24 billion, accounting for 89.56% of the total 24-hour volume of the crypto market.

Due to continuing cash problems mostly driven by low Bitcoin prices and high energy expenses, some US mining corporations unplugged on Tuesday morning in Asia, resulting in a 3.59% drop in the difficulty of mining Bitcoin.

Based on data from BTC.com, the mining difficulty reading for Tuesday's bimonthly adjustment was 34.09 trillion at block height 770,112, a 3.27% increase over the last adjustment on December 19.

When compared to the previous record low of 24.37 trillion on January 8 of last year, the current Bitcoin mining difficulty estimate is approximately 40% higher.

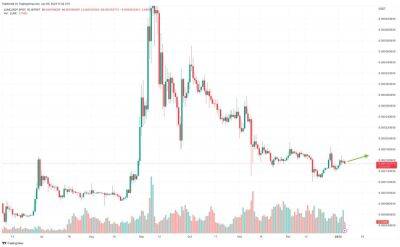

The current bitcoin price is $16,748, and the volume of trading in the last 24 hours is $11 billion. On the technical front, Bitcoin is facing significant resistance at $16,800, and a bullish breakout of this level could determine future market trends. BTC's immediate resistance remains at $16,950, and a bullish crossover above this level could take BTC to $17,150.

The RSI and MACD indicators have entered the

Read more on cryptonews.com