Bitcoin Price and Ethereum Prediction: BTC and ETH Poised for 50% Retracement; Brief Market Analysis

In this update, we will explore the predictions for these two leading cryptocurrencies, as they appear to be positioned for a significant 50% retracement.

We will discuss a brief analysis of the market conditions surrounding Bitcoin and Ethereum, highlighting key factors that may influence their price movements in the near future.

Stay tuned for valuable insights into the potential direction of these digital assets.

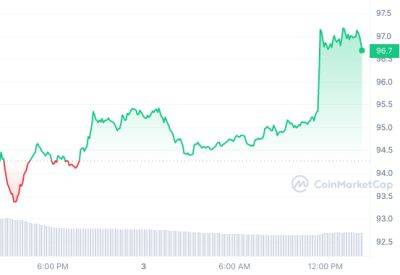

The current price of Bitcoin is $27,700, and it has experienced a trading volume of $17 billion over the past 24 hours. In this timeframe, Bitcoin has seen a nearly 0.50% increase.

As per CoinMarketCap, Bitcoin holds the top ranking (#1) with a market capitalization of $537,048,136,864.

Currently, 19,387,487 BTC coins are circulating out of a maximum supply of 21,000,000 BTC coins.

Bitcoin is currently facing significant resistance at the $28,300 level from a technical standpoint. This level is further reinforced by the presence of a 'double tap' pattern observed on the four-hour timeframe.

The consistent closing of candles below this level indicates a possible exhaustion among buyers, potentially leading to sellers gaining temporary dominance in the market.

To support this analysis, prominent technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) have been examined.

Additionally, the 50-day exponential moving average (EMA) is positioned around the $27,000 level, while the current market price of Bitcoin is approximately $28,000.

This significant disparity between the market price and the 50-day EMA suggests an overbought market condition, which could potentially trigger a notable correction in Bitcoin's price.

If this scenario unfolds and Bitcoin fails to

Read more on cryptonews.com