Bitcoin Option Markets Keep Sending Bullish Signals – Here’s the Implications for BTC Price

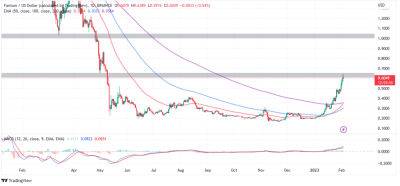

Bitcoin options markets continue to signal that investors are anticipating further upside in the BTC price. According to a chart on The Block, the widely followed Bitcoin 25% delta skew has remained above zero since the middle of January and recently hit its highest since Q4 2021 at close to 6.0.

The 25% delta options skew is a popularly monitored proxy for the degree to which trading desks are over or undercharging for upside or downside protection via the put and call options they are selling to investors. Put options give an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price.

A 25% delta options skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies there is higher demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

The sustained rise in Bitcoin’s 25% delta option skew is a sign that investor sentiment towards the world’s largest cryptocurrency by market capitalization has taken a substantial turn for the better in January. Another options market indicator called the Open Interest Put/Call Ratio is also signalling a recovery in sentiment.

According to a chart on the Block, the ratio between open BTC put and call options on derivatives exchange Deribit was last at 0.46, close to its lowest since January 2022. It spiked as high as 0.61 in the immediate aftermath of the FTX cryptocurrency’s collapse in early November.

Bullish signals regarding the kind of protection investors are demanding in the Bitcoin options market add to a

Read more on cryptonews.com