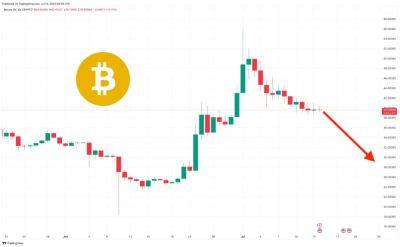

Bitcoin Miners Move 54,000 BTC to Binance as Liquidity Drops

Recently, significant Bitcoin transactions have been observed in the market. According to Ki Young Ju, the CEO of CryptoQuant, Bitcoin miners have reportedly transferred a whopping 54,000 BTC to Binance over the last three weeks.

This dramatic shift was announced via a series of tweets by Ki Young Ju, which rises speculation about potential implications on Bitcoin's market dynamics.

Despite the major transfer of Bitcoin to Binance, the leading cryptocurrency exchange, there hasn't been a significant change in the Bitcoin-USD open interest. The CEO's tweets suggest that this hints towards a reduced likelihood of using these funds to create new long positions. Instead, it points more towards the possibility of spot selling.

A broader look at the market reveals a diminishing crypto liquidity on both ends of the spectrum. CryptoQuant's data showcases a decline in the sell-side liquidity for cryptocurrencies, albeit accompanied by an even sharper fall in the buy-side liquidity.

Crypto exchange reserves have also seen a downward trend, further corroborating the liquidity squeeze. In the span of a year, Bitcoin's exchange reserve has decreased by 20%, while Ethereum (ETH) and stablecoins experienced a more drastic decline of 40% and 52% respectively.

This liquidity crunch in the crypto market, coupled with the significant transfer of Bitcoin to Binance, may be setting the stage for potential price volatility. Market stakeholders and investors are closely watching these unfolding developments to gauge their impact on Bitcoin and other cryptocurrencies' pricing and trading behavior.

Read more on blockchain.news