Bitcoin hodlers exited 'capitulation' above $20K, new metric hints

Bitcoin (BTC) is in a “transition," which should pave the way to the next bull market top, new research has concluded.

In the latest edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode unveiled its latest tool for tracking Bitcoin’s resurgence.

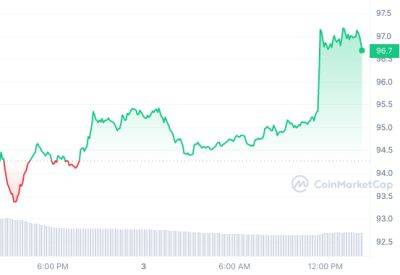

After the 2022 bear market and signs of recovery in Q1 this year, on-chain metrics have undergone a broad transformation, many suggesting that a long-term BTC price bottom is already in.

With price action stagnating since mid-March, however, doubts have returned — along with downside targets which stretch toward $20,000.

For Glassnode analysts, however, Bitcoin’s long-term investor base is already preparing for better times ahead.

Using existing on-chain tools, analysts unveiled a new way of tracking sentiment among these long-term holders (LTHs) — those hodling BTC for at least 155 days.

The tool, “Long Term Holder Spending & Profitability,” splits LTH behavior patterns into four phases.

After a period of “capitulation” at the end of 2022, LTHs have begun a “transition” toward a state of “equilibrium” before full “euphoria” — the next BTC price cycle top — hits.

Capitulation is defined as a situation in which “Spot price is lower than the LTH cost basis,” Glassnode explains, with significant LTH spending thus “likely due to financial pressure and capitulation.”

Transition, meanwhile, is when the “Market is trading slightly above the long-term holders cost basis, and occasional light spending is part of day-to-day trade.”

The LTH cost basis, as of May 30, lies at around $20,800, separate data shows.

“Our current market has recently reached the Transition phase, flagging a local uptick in LTH spending this week,” “The Week On-Chain” commented.

Complementing LTHs,

Read more on cointelegraph.com