Bitcoin dips below $25K for the first time in 3 months

The price of Bitcoin (BTC) has fallen below the $25,000 mark for the first time since March 17 following a hawkish Fed announcement amidanother turbulent week for the crypto industry.

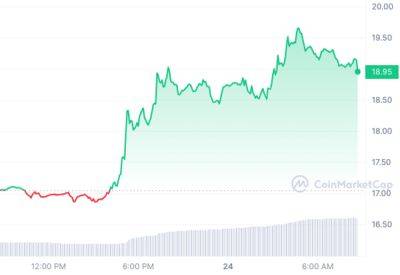

Within the span of 30 minutes on June 15, the price of Bitcoin fell 4% from $25,867 to $24,819 according to data from TradingView. At the time of publication Bitcoin has regained ground and is holding just above $25,000.

Over the past week Bitcoin had been holding around the $26,000 region as the market came to grips with the SEC’s legal action against crypto exchange heavyweights Coinbase and Binance as well as increasing macroeconomic uncertainty around interest rate signals from the United States Federal Reserve.

The sharp drop in price arrived roughly three hours after the Federal Reserve announced a pause on interest rate hikes, following a fifteen-month-long campaign of rate increases to combat surging inflation.

While the market was almost unanimously expecting a rate pause, the Federal Open Markets Committee statement hinted at further rate hikes in the future, which typically blunts investor excitement for risk assets like cryptocurrencies.

According to eToro Market Analyst Josh Gilbert, Federal Reserve chair Jerome Powell has made it quite clear that this is only a temporary pause, something that could spell further trouble for Bitcoin in the long-term.

"Much of the positivity we’ve seen from risk assets this year, including Bitcoin, is built on the expectation that inflation will fall and interest rates will peak, and then begin to be cut," Gilbert said.

Related: SEC, CPI and a ‘strong rebound’ — 5 things to know in Bitcoin this week

The second largest cryptocurrency by market cap, Ether (ETH), also took a hit, falling

Read more on cointelegraph.com