Bitcoin climb fails to dispel fears that FTX contagion is ‘far from over’

Worries about contagion from the implosion of digital-asset exchange FTX clouded a rise in Bitcoin and other cryptocurrencies Tuesday.

The largest token rose as much as 2.1% and was trading at about $16,485 as of 10:23 a.m. in London. Second-ranked Ether also posted gains, while meme token Dogecoin surged 10% at one point.

Bitcoin has so far mostly weathered BlockFi Inc.’s bankruptcy on Monday. The crypto lender unraveled in the wake of the chaotic demise of Sam Bankman-Fried’s FTX and sister trading house Alameda Research.

The crypto world is now nervously watching for further fallout from FTX, with the spotlight trained on the likes of struggling brokerage Genesis.

“The credit contagion is far from over," said Cici Lu, founder at Venn Link Partners, a crypto consultancy. There’s “still very low visibility, in the second and third layers of counterparty risk, in terms of who’s exposed to what," Lu added.

Bitfront, a crypto exchange backed by Japan’s social media giant Line Corp., said it’s shutting down amid industry challenges but indicated the step isn’t connected to the collapse of FTX.

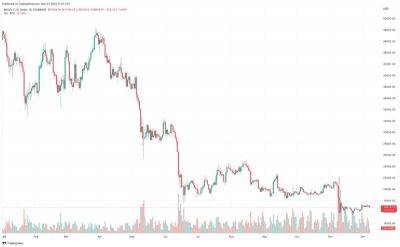

Bitcoin chart patterns continue to flash warning signs about the token’s outlook. An analysis based on plotting sessions when the token moves up or down by at least 10%, a so-called point and figure study, signals the coin is at risk of testing support levels running as low as about $10,000.

Both Bitcoin and a gauge of the top 100 tokens have shed more than 60% this year, a rout that contributed to a spate of blowups at crypto outfits.

This story has been published from a wire agency feed without modifications to the text.

Read more on livemint.com