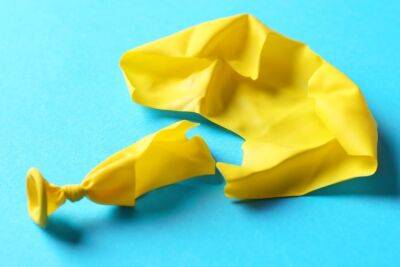

Bitcoin bounces after rout but vibe is still 'strongly negative'

Bitcoin snapped a 12-day slide, taking a breather to bounce along with the rest of the cryptocurrency market after a record-breaking string of declines. Analysts cautioned the respite may be brief.

The world’s largest cryptocurrency climbed as much as 12% early Sunday, recouping some of its losses from a steep drop Saturday that sent the token to as low as $17,599. It stood at $19,500 as of 9:15 a.m. in New York. Ether, which touched as low as $881 in the selloff, climbed 15% to $1,040, while alternative coins from Avalanche to Solana also enjoyed gains. Even with the bounce, Bitcoin is down almost 40% this month and more than 70% from its all-time high reached in November.

“For those who like to buy low and sell high, I think most can agree that it’s the former now,” said Mati Greenspan, founder of Quantum Economics.

The crypto market is known for its wild swings -- particularly on weekends, when moves can be magnified -- and the whipsaw of the past two days provided the latest example. Still, the overall tone remains negative, with monetary tightening providing macro headwinds and crises within crypto raising concerns about widening distress.

Trading has been heavier than normal this weekend, with Bitcoin volume approaching $40 billion in the past 24 hours as of about 9 a.m. New York time, according to CoinGecko. Last Saturday and Sunday, volumes stood at $25.6 billion and $22.5 billion, respectively.

Bitcoin’s leg down on Saturday pushed the coin below $19,511, the high it hit during its last bull cycle in 2017, which it reached at the end of that year. Throughout its roughly 12-year trading history, Bitcoin has never dropped below previous cycle peaks. The token also broke through a technical support level of

Read more on business-standard.com