Binance-FTX saga deepens crypto investors' fears, Bitcoin near two-year low

Just as the investors were consolidating their positions in the cryptocurrency market, the news of Binance selling all its FTX tokens pulled the rug from under their feet. The total crypto market cap has fallen nearly $150 billion since the announcement on Tuesday with the FTX token, FTT, losing 75.85 per cent. FTX is the third largest crypto exchange in the world, and Binance is the largest.

Binance later announced that it was acquiring FTX but it failed to control the fall in crypto prices.

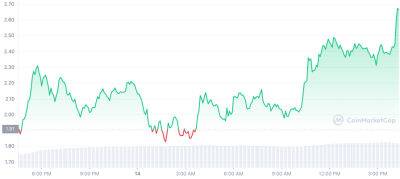

Bitcoin, the largest cryptocurrency by m-cap, was at its lowest level since November 2020 and has fallen over 10 per cent in the same period and Ethereum has plunged nearly 20 per cent. As of 4 PM (IST), Bitcoin was trading at $17,633 and Ethereum at $1,196, according to coinmarketcap. Other major tokens like Cardano, Dogecoin and Polygon were in the red.

"This reflects the state of crypto today. Cryptocurrency investors, especially the working class, are in deep fear since the currency was created solely to be used as collateral to raise funds. There are over a billion dollars in pending withdrawals on FTX," Taaran Chanana, managing director & co-founder of tech platform MemeChat said.

During the day Bitcoin fell to nearly $17,000.

"Bitcoin fell to a year’s low of $17,100 with Binance’s takeover of Sam Bankman-Fried’s FTX imminent amidst worries of how FTX's liquidity and solvency problems raised questions about the health of their balance sheet as they had repeatedly borrowed their own FTT token as collateral," crypto trading platform CoinDCX's research team told Business Standard.

What went wrong with FTX?

Bankman-Fried of FTX had become the face of the crypto industry. In 2017, he established Alameda Research, a venture

Read more on business-standard.com