Biggest Crypto Gainers Today on Uniswap – CBDC, TEST, TRUMP

Despite a slide in the Bitcoin (BTC) price to fresh 2024 lows under $41,500 in recent trade, crypto degens hunting fast gains continue to drive explosive action in low-cap markets, with CBDC, TEST and TRUMP the biggest crypto gainers today on Uniswap.

The majority of major cryptocurrencies are trading in the red on Thursday, as per CoinMarketCap.

The sell-off appears Bitcoin-led, with the cryptocurrency still suffering a sell-the-fact reaction to last week’s spot Bitcoin ETF approvals.

New spot Bitcoin ETFs have attracted strong demand since launch.

BlackRock’s ETF has already attracted over $1 billion of inflows.

However, much of that appears to be a rotation, with Grayscale in the process of selling substantial amounts of Bitcoin from its Grayscale Bitcoin Trust ETF.

Concerns about Grayscale sales appear to be weighing on the Bitcoin price.

The macro backdrop is also a headwind, with the US dollar and US yields pushing higher.

Bitcoin’s long-term outlook remains strong, thanks to the upcoming halving, expected Fed rate cuts this year and ongoing ETF inflows.

But in the near term, the price may continue to decline, with a retest of sub-$40,000 levels possible.

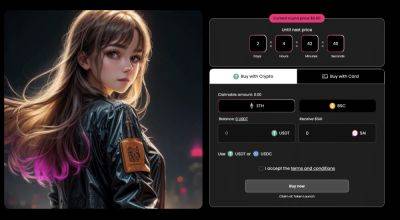

The downbeat outlook is set to increase the attractiveness of the wild low cap crypto markets.

New meme coins and shitcoins can routinely deliver gains in the region of 5-10x within 24 hours.

That’s given the very low levels of liquidity in the low-cap token market.

But just as tokens can quickly see huge gains, they can also quickly see huge losses.

The market for new shitcoins and meme coins is also replete with scams.

Scammers may try to market and promote a new token to generate a price pump, only then to abandon a project after cashing in, which is referred to as a “rug

Read more on cryptonews.com