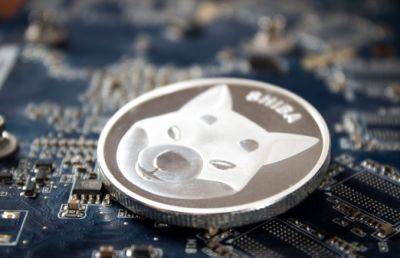

Biggest Crypto Gainers Today on DEXTools – X–Bird, NCWW, XSHIB

A U.S. appeals court overturned a previous SEC decision on Tuesday, ruling in favor of asset management firm Grayscale Investments in its effort to launch a spot bitcoin exchange-traded fund (ETF).

The unanimous verdict by the U.S. Court of Appeals for the District of Columbia could pave the way for regulatory approval of the first spot bitcoin ETF in the country, pending any appeals by the SEC.

Given shifting macroeconomic dynamics and bitcoin rising 5% so far today, what are the biggest crypto gainers today?

The SEC now has 45 days to appeal the ruling to the Supreme Court or request an 'en banc' review by a panel of judges.

The agency had previously rejected applications for spot bitcoin ETFs by Grayscale, Ark Investments, Fidelity, and others, citing concerns around potential manipulation in the underlying bitcoin market.

In its decision, the appeals court stated that the SEC "failed to demonstrate that the bitcoin market is uniquely resistant to manipulation."

Grayscale has argued that a spot Bitcoin ETF would expand access to Bitcoin exposure for retail investors without needing to directly own the cryptocurrency. The firm's Bitcoin Trust (GBTC) currently trades at a premium to net asset value.

Following the ruling, the price of bitcoin jumped over 5% to $27,450, extending its rebound from multi-year lows reached earlier in 2022.

However, the cryptocurrency remains down 60% from its all-time high of close to $69,000 in November 2021. Shares of GBTC surged over 16% on the news.

The ruling is a significant victory for Grayscale after years of legal wrangling with the SEC over approval of a spot bitcoin ETF.

However, the SEC still has options to continue challenging the decision, including appealing to the Supreme Court or

Read more on cryptonews.com