Beijing: Digital CNY Will Tread Line Between Ensuring Privacy and Fighting Crime

China’s central bank digital currency, the digital yuan, continues to break new ground. And while it is already in use at over 5.6 million stores in the nation, its architects say they will build privacy-protecting functions into the coin.

Per the Chinese media outlet International Business Daily, Central Bank figures show that as of the end of August, 360 million transactions involving the digital yuan had been completed. The coin is currently being piloted in 15 of the nation’s biggest cities.

The coin’s total transaction volume grew some 14% from August 2021. And the central People’s Bank of China (PBoC) added that it intends to “expand the scope of [its] pilot programs.” It also wants to look at more ways in which the coin can be tested in real-world scenarios.

The bank also suggested that it wanted to look at “international cooperation” options. The PBoC has previously suggested that the e-CNY is primarily a domestic project and not a tool of international trade. But it has admitted that it may one day develop cross-border payment solutions for the coin.

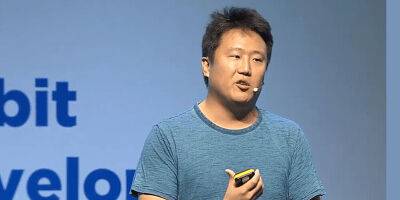

China Net Finance reported that at recent fintech event held in Hong Kong, Yi Gang, the PBoC Governor, underlined this point again. He insisted that the digital CNY was “mainly intended as an M0” solution – i.e. a digital alternative to banknotes and coins.

He insisted that digital yuan research was being conducted “mainly to meet domestic retail payment needs, improve levels of financial inclusion, and improve the efficiency of the central bank's currency issuance and payment systems.”

International critics have suggested, however, that the coin will be used as a way to control the public’s spending and monitor citizens’ behavior. Some have tried to dissuade non-Chinese

Read more on cryptonews.com

cryptonews.com

cryptonews.com