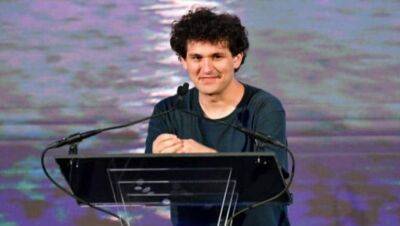

Bahamas freezes certain FTX assets, further crippling Sam Bankman-Fried's troubled crypto trading firm

Photo by Alex Wong/Getty Images

Sam Bankman-Fried's bad week has just gotten worse.

Certain assets of FTX Digital Markets — a subsidiary of Bankman-Fried's FTX crypto exchange — have been frozen by the Bahamas securities regulator, the authorities said in a media release on Thursday

Attorney Brian Simms, K.C. was appointed as a provisional liquidator, after the authorities petitioned the Supreme Court of The Bahamas, the the release states.

FTX, which relocated its headquarters from Hong Kong to the Bahamas in September 2021, has been embroiled in a liquidity crisis for days.

The Securities Commission of the Bahamas said in the announcement it's aware of statements suggesting FTX mishandled, mismanaged, or transferred the assets of clients to Alameda Research, Bankman-Fried's crypto trading firm.

«Based on the Commission's information, any such actions would have been contrary to normal governance, without client consent and potentially unlawful,» the Bahamian securities regulator added.

Sources told Reuters Bankman-Fried had transferred $4 billion from FTX to Alameda earlier in 2022 without telling anyone, the news agency reported on Thursday.

The Bahamian securities commission added it has determined the «prudent course of action» was to put FTX Digital Markets into provisional liquidation so as to «preserve assets and stabilize the company.»

Bankman-Fried had told investors that the firm faces bankruptcy if it did not receive emergency funding, Bloomberg reported earlier on Thursday, citing a person with direct knowledge of the matter. FTX faces a shortfall of up to $8 billion and was trying to raise $4 billion to stay solvent, per Bloomberg.

Later in the same day, FTX announced on Twitter it reached an agreement with

Read more on markets.businessinsider.com

markets.businessinsider.com

markets.businessinsider.com