Australian Federal Court Rules Against Block Earner for Unlicensed Financial Services Conduct

An Australian federal court has determined that fintech company Block Earner engaged in unlicensed financial services conduct by offering its crypto-backed Earner product.

The Federal Court finds fintech company Block Earner engaged in unlicensed financial services conduct when offering its crypto-backed Earner product https://t.co/TS7Xf8emuf pic.twitter.com/XOrxvZsEft

— ASIC Media (@asicmedia) February 9, 2024

The court has drawn a nuanced line regarding crypto-yield products, indicating that while those promising managed yields necessitate a financial services license, decentralized-finance (DeFi) “pass-through” products may not.

The ruling, issued on Feb. 9 by federal court judge Ian Jackson, addressed Block Earner’s offerings, imposing penalties over its “Earner” product while refraining from applying the same to its DeFi “Access” product.

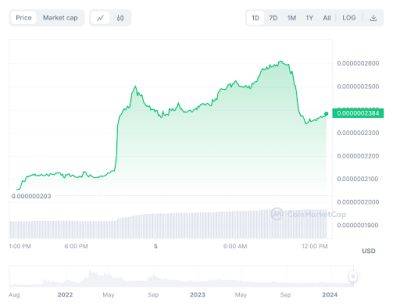

Block Earner, facing penalties for its “Earner” product’s offering in 2022, which entailed yield for loans, Bitcoin (BTC), Ether, and PAX Gold (PAXG), was deemed to require an Australian Financial Services License (AFSL), according to Jackson’s order. This ruling marks one of the first decisions on the application of financial services law to crypto-backed products.

The Court found that Block Earner’s Earner product constituted an unregistered managed investment scheme and facility for making a financial investment under the law, thus requiring licensing. However, the court differentiated Block Earner’s DeFi “Access” product, stating that it did not operate under a managed investment scheme and was hence exempt from AFSL requirements.

From March 2022 to November 2022, Block Earner provided consumers with the Earner product, enabling them to earn fixed-yield returns from various

Read more on cryptonews.com