As negative sentiment permeates the market, crypto assets record outflows: Report

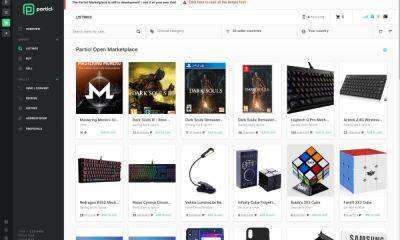

In a new report, CoinShares, a digital asset investment firm, reported a significant shift in investor sentiment toward cryptocurrencies. After several weeks of price growth for many digital assets, negative sentiment has re-entered the market, resulting in two consecutive weeks of outflows from digital asset investment products.

As per CoinShares, in the last week, digital asset investment products

“Saw outflows totaling US$32m last week, the largest since late December 2022.”

The report, released on 20 February, suggested that investors have become increasingly cautious about further price rallies, prompting them to withdraw their funds from the market to hedge against any sudden price drops.

The shift in sentiment is a stark contrast to the bullish outlook that has been prevalent in the last month as leading digital assets such as Bitcoin [BTC] and Ethereum [ETH] saw significant price gains culminating in increased inflows for these assets.

Source: CoinShares

According to the report, of the $32 million removed from the digital assets investments market last week, leading cryptocurrency BTC was the most affected, recording up to $25 million in outflows. This represented 78% of the total sums taken out.

In the previous week, BTC saw outflows that totaled $10.9 million. The recent $25 million outflows brought the total outflows for the king coin on a month-to-date to $35.9 million.

Interestingly, the case was different for short-bitcoin investments. After logging a minor outflow of $3.5 million the week before, the asset class saw inflows totaling $3.7 million last week. CoinShares found:

“Short-bitcoin investment products saw inflows of US$3.7m and has seen some of the largest inflows YTD of US$38m, second only to

Read more on ambcrypto.com

ambcrypto.com

ambcrypto.com

![Litecoin [LTC] retests support after bearish cycle: Will bulls emerge victorious? - ambcrypto.com - city Santimentin - city Santimenta](https://gocryptonft.com/storage/thumbs_400/img/2023/2/24/89440_etw.jpg)

![Uniswap [UNI] falls to key support, can 50% Fib level prevail? - ambcrypto.com - city Santiment](https://gocryptonft.com/storage/thumbs_400/img/2023/2/24/89439_xrvvv.jpg)