As Bitcoin Sits Comfortably Atop $30K, On-Chain Metrics Suggest Further Upside For the BTC Price

Bitcoin (BTC), the most valuable cryptocurrency in the world by market capitalization that powers the world’s first cryptographically secured, decentralized payments ledger, hit its highest level since June 2022 on Thursday to the north of the $30,600 level.

BTC/USD was last changing hands up in the region of 1.6% on the day, having recovered well from an earlier dip to the south of the $30,000 mark.

The latest push higher, which was catalyzed by a bullish breakout to the north of a pennant structure late last week, has seen Bitcoin extend its on-the-year gains to more than 80%.

That makes Bitcoin one of the best-performing major assets in the world.

The April rally, which has seen BTC pop over 6.5% already this month, comes as a string of US data show 1) US economic activity is fast slowing, 2) inflation continues to drop quickly and 3) while still healthy, the US labor market may also be turning.

All of this at a time when the effects of last month’s bank crisis (which is expected to trigger a credit crunch) are yet to start being felt in the US economy.

In other words, the likelihood of a US recession is fast rising.

Rising hand in hand with this are bets that the US Federal Reserve will soon stop hiking interest rates and embark on a cutting cycle, resulting in an easing of financial conditions that has historically been a massive tailwind for the Bitcoin price.

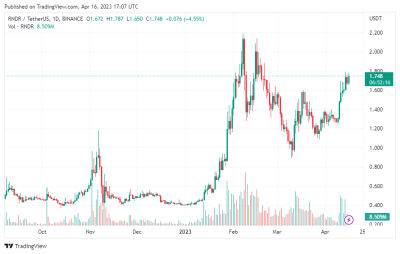

Chart analysis suggests that continued Bitcoin price upside remains a distinct likelihood.

Since breaking to the north of last month’s highs in the mid-$29,000s, the door has now been opened for BTC to hit the next major resistance area around $32,300 (the late-May/June 2022 highs).

All of BTC’s major moving averages are moving higher in consecutive order and the

Read more on cryptonews.com