Algorand (ALGO) Price Prediction 2025-2030: ALGO sees second week of losses

Disclaimer: The datasets shared in the following article have been compiled from a set of online resources and do not reflect AMBCrypto’s own research on the subject.

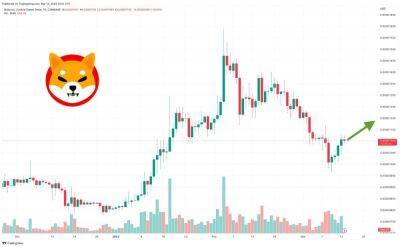

AlGO-USD lost most of its gains at the end of February 2023, after soaring by about 30% at the beginning of the month. The price saw a modest 1.2% increase at the month’s end. After ending last week with an 8% drop, Algorand’s (ALGO) pricing saw its second straight week of losses. Even after numerous tries, the price could not rise above the $0.28 mark.

Read Price Prediction for Algorand [ALGO] for 2023-24

The initiative has engaged its first Chief Financial Officer (CFO), Mathew Commons, who was hired for the new position. This appointment takes place at a time when the Algorand ecosystem is expanding extremely quickly.

Since the beginning of the year, the total locked value (TVL) has been rising rapidly. At the end of 2022, it was $75 million; today, it is $171 million. The price of Algorand and other locked assets has increased, which accounts for the majority of this TVL increase.

On the daily chart, Algorand (ALGO) was struggling with the crucial $0.28 level. When the price fell below this level in November 2022, it took on a life of its own. This region now presents even more formidable opposition to Algorand because of the 200-day moving average (ALGO-USD).

Although Algorand (ALGO) is intended to be a very effective proof-of-stake (PoS) blockchain, other networks like Ethereum (ETH), BNB Chain, and Solana (SOL) have been at the forefront of significant DeFi activity. The narrative surrounding the blockchain appears to be changing for the better based on the increase in Algorand’s DeFi TVL during the past week.

Algorand has created a mark in

Read more on ambcrypto.com

![Will Polkadot [DOT] maintain its price surge this week? Data suggests… - ambcrypto.com](https://gocryptonft.com/storage/thumbs_400/img/2023/3/13/90970_d5p7.jpg)