AI and dot-com bubble share some similarities but differ where it counts

Artificial intelligence (AI) has seen tremendous growth in recent years, exploding into popular culture and industry and leading to comparisons with the now infamous dot-com bubble and crash of the 1990s.

During the late 1990s up until the early 2000s, internet-based companies were the subject of massive hype and investment, with the sector peaking at a value of $2.95 trillion before slumping to $1.195 trillion as capital dried up and investors left in droves, causing many companies in the industry to go bust.

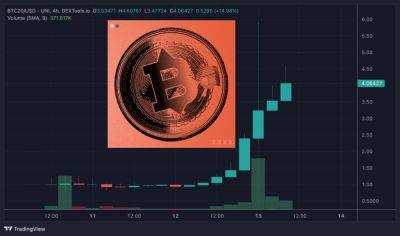

According to data from analytics platform Statista, the AI market has seen steady growth since 2021, with the current market size estimated to be around $200 billion and forecasted to reach $1.8 trillion by 2030.

Speaking to Cointelegraph, Henry Nothhaft Jr., who has worked in the AI industry since 2009 in various roles and founded the early AI software company Trapit, said the rapid expansion of AI and the dot-com bubble share some key attributes.

Nothhaft pointed to the scale of impact on the economy and society in both cases. AI, in particular, has been a polarizing topic, prompting tech leaders like Elon Musk to warn of impending doom while also investing in the sector.

Related: AI-related crypto returns rose up to 41% after ChatGPT launched: Study

“Both represent transformative technological innovation that redefine industries and change societal behaviors,” he said.

“As with the dot-com bubble, with AI, we’re experiencing a hype cycle characterized by rapid innovation, a frothy investment environment, a lot of new entrants and, I think, inflated expectations,” Nothhaft added.

Although Nothhaft thinks it’s still early to make a call on just how inflated expectations are for AI, he does believe that most

Read more on cointelegraph.com