2022: A very unusual year

While investors in India have heard how tough 2022 was for global investors, most do not fully appreciate the extent of global wealth destruction. India, after all, had its seventh year of positive equity market returns in local currency terms (though it had negative 8.6 per cent returns in dollar terms). Indian markets are also not that far from their all-time highs. Most investors in Indian stocks are still in the money as we speak.

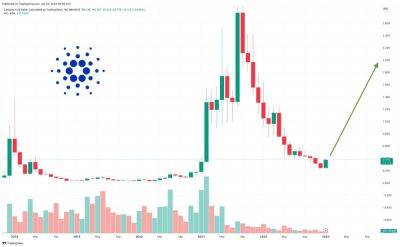

However, for global investors, 2022 was a nightmare best forgotten. Just for context, global equities, bonds and crypto assets combined have seen a drawdown of $26 trillion from their peak. This is 26 per cent of the global gross domestic product or GDP, and the bulk of this decline took place in 2022. Tesla, Bitcoin, Meta and the ARKK innovation fund were all down about 65 per cent, with unprofitable technology companies down even more. It was such a tough year that the only sector actually up even 5 per cent for the year in the US was energy (65 per cent gain). Every other major sector was down for the year.

We have seen these types of wipeouts before. Following the global financial crisis in 2008 and the dot-com bust in 2000, we saw similar levels of declines for the financials and technology stocks. However, what made 2022 unique was the simultaneous decline in both bond and equity markets. This is the only year ever in which the S&P 500 and 10-year US treasuries both delivered negative returns of over 10 per cent (total return terms). This has never happened before. In the two most recent episodes of the S&P 500 declining by more than 20 per cent, 2002 and 2008, bonds delivered positive returns of more than 15 per cent in each year. They balanced the equity losses and provided

Read more on business-standard.com